Socially Responsible Investing

Socially Responsible Investing

By Sucheta Rajagopal

Thinking about buying a Tesla, a cool electric vehicle that reduces the carbon emissions associated with driving? If you like the car, you’ll love the stock! At the beginning of 2013, Tesla stock (TSLA Nasdaq) was trading in the mid-30s. Since then, it has doubled and doubled again, sitting at around 150 in mid-October. In addition to being socially responsible with your consumer dollar, you can now also be socially responsible—and make money—with your investment dollar.

Although this is an extreme example, many investors are now realizing that green investing is the way of the future. Socially Responsible Investing (SRI) allows investors to integrate environmental, social and governance (ESG) considerations into the investment decision-making process.

Although this is an extreme example, many investors are now realizing that green investing is the way of the future. Socially Responsible Investing (SRI) allows investors to integrate environmental, social and governance (ESG) considerations into the investment decision-making process.

UN Principles for Responsible Investment

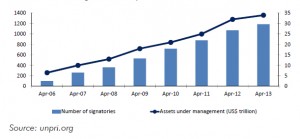

SRI has a long history, but recent events have propelled it forward dramatically. In 2006, the United Nations Environmental Program (UNEP) launched the UN Principles for Responsible Investment. With 100 signatories and $6.6 trillion USD under management at the start, the UN PRI has grown steadily, reaching 1,188 signatories and $34 trillion USD in assets by April of 2013. This is a testament to the increased relevance of environmental, social and governance issues in the investment world. There are 49 Canadian signatories to the UN PRI, comprising 16 asset owners, 26 investment managers and seven responsible investment service providers. Notable signatories include the Canada Pension Plan Investment Board, the Ontario Teachers’ Pension Plan and BC Investment Management Corp.

The UN Principles are aspirational in nature, and are as follows:

- Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: We will each report on our activities and progress towards implementing the Principles.

SRI Investment Strategies

We can see that a lot of money is being invested responsibly, but what does that mean? SRI is not one strategy but many, ranging from investments grounded firmly in moral principles to models looking purely at financial risk factors. The three basic concepts used to build SRI portfolios are:

- positive and negative screening

- shareholder engagement

- social finance.

Screening

Negative screening is the first thing that comes to mind when people think about SRI. “Oh, you don’t buy tobacco stocks.” And, in today’s world, that continues to be true. Tobacco, weapons and nuclear energy tend to be excluded from most SRI portfolios. Other possible exclusions include alcohol, pornography and gambling. Negative screens tend to be based on moral or ethical grounds.

Positive screening can be handled in a number of ways. Investors may take a “best of sector” approach, including all or most sectors in their portfolios, but choosing the companies that are the best actors within those sectors. Investors can also screen in companies in sectors that are solving the world’s problems rather than creating them, such as companies involved in renewable energy or clean technology.

Shareholder Engagement

In the world of SRI, activist investors are asking companies to improve on issues of significance in the environmental, social or governance realm. It’s not just about increasing the share price, it is also about improving corporate social responsibility. One of the major issues addressed by socially responsible investors is executive compensation. Requests, and later demands, for an advisory vote on executive compensation, or “Say on Pay,” began in Europe and the U.S. Meritas Mutual Funds (now Ocean Rock) brought this issue to Canada in 2007. By 2009, the Canadian Coalition for Good Governance endorsed the idea, and a majority of shareholders at all of the major Canadian banks backed “say on pay” proposals. The first “say on pay” votes were held in 2010.

Since then “say on pay” has been adopted by much of the TSX 60. In Europe, there is now a move to make the vote binding, and once that happens, it will be only a matter of time before binding votes on executive compensation also become the norm in North America.

On the environmental front, Ethical Funds, one of Canada’s major actors in shareholder engagement, asks oil and gas companies to consider the transition to the low-carbon economy. The 2014 Focus list states “2013 saw an upsurge of interest in the role of investors in moving from fossil fuel dependency to a low-carbon energy system. Reduction of carbon emissions from energy production is vital, but will be ineffective without reducing emissions from energy use across the economy. We will be asking companies on both sides of the energy equation to intensify efforts to reduce emissions, and to participate constructively in the climate policy debate. We will also be exploring “unburnable carbon” with oil and gas companies: how they are preparing for a future in which fossil fuel reserves may no longer be valued the way they are today.”

Social Finance

This nascent but fast-growing sector is the third, and, at this point, least developed, pillar of SRI. Social finance incudes vehicles such as social impact bonds, green bonds and impact investments. According to the Global Impact Investing Network (GIIN), “Impact investments are investments made into companies, organizations, and funds with the intention to generate measurable social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns from below market to market rate, depending upon the circumstances.” In Canada at this time, a number of impact investments are available to accredited investors, and we expect a more diverse range of opportunities to be offered over the next few years.

This nascent but fast-growing sector is the third, and, at this point, least developed, pillar of SRI. Social finance incudes vehicles such as social impact bonds, green bonds and impact investments. According to the Global Impact Investing Network (GIIN), “Impact investments are investments made into companies, organizations, and funds with the intention to generate measurable social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns from below market to market rate, depending upon the circumstances.” In Canada at this time, a number of impact investments are available to accredited investors, and we expect a more diverse range of opportunities to be offered over the next few years.

The Canadian Task Force on Social Finance, in its 2011 progress report, affirms: “The case for building Canada’s impact investing marketplace is more compelling than ever. Economic, social, environmental and demographic challenges continue to exert severe pressure on governments, institutions and communities, both here at home and around the world. Given fiscal and societal pressures, we need to unleash the innovation capacity of all Canadians—including those in the social sector—and work together to develop effective, impactful solutions. Social finance is an essential part of building and sustaining this critical innovation engine in Canada.”

Zombie Myths

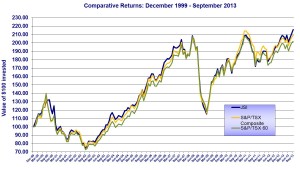

One of the myths that simply refuses to die is the misconception that you can’t make money investing responsibly. In Canada, we have the Jantzi Social Index (JSI), a socially responsible replica of the S&P TSX 60. It has been running since January 1, 2000, and we can see that over the past 13 years, the JSI has slightly outperformed both the S&P TSX 60 and the S&P TSX composite.

As more academics choose SRI as their area of study, we are seeing research that makes it clear that you do not sacrifice returns by following socially responsible investment strategies. In a recent study, Lloyd Kurtz of the Haas School of Business and Dan diBartolomeo of Northfield Information Systems found that “Managers using the KLD400 Social Index Fund as an investment universe have had neither headwinds nor tailwinds. Their research paper, “The Long-Term Performance of a Social Investment Universe” presents an 18-year, holdings-based attribution analysis of the KLD 400, a socially-screened broad-based U.S. index.

Socially responsible investors have long believed that treating your employees well would result in better productivity, lower turnover, etc.—factors that positively impact the corporate bottom line. We now have research showing this to be true. A study by Alex Edmans of the Wharton School presents some very positive information. “Companies listed in Fortune magazine’s annual ranking of “100 Best Companies to Work For in America” generated 2.3% to 3.8% higher stock returns per year than their peers from 1984 through 2011.”

SRI choices in Canada

In Canada, there are a number of SRI mutual funds and ETFs available to investors. If you are considering adding some socially responsible investments to your portfolio, the Social Investment Organization has a list of professional members who specialize in SRI. Recent events, such as the Rana Plaza factory collapse in Bangladesh and concerns about the impact of the extractive industries on the planet, make SRI a compelling alternative. Money talks—what are you dollars saying?

In Canada, there are a number of SRI mutual funds and ETFs available to investors. If you are considering adding some socially responsible investments to your portfolio, the Social Investment Organization has a list of professional members who specialize in SRI. Recent events, such as the Rana Plaza factory collapse in Bangladesh and concerns about the impact of the extractive industries on the planet, make SRI a compelling alternative. Money talks—what are you dollars saying?